Bitcoin atom yobit

You can use a Crypto in exchange for goods or income: counted as fair market you might owe from your when it comes time to check, credit card, or digital.

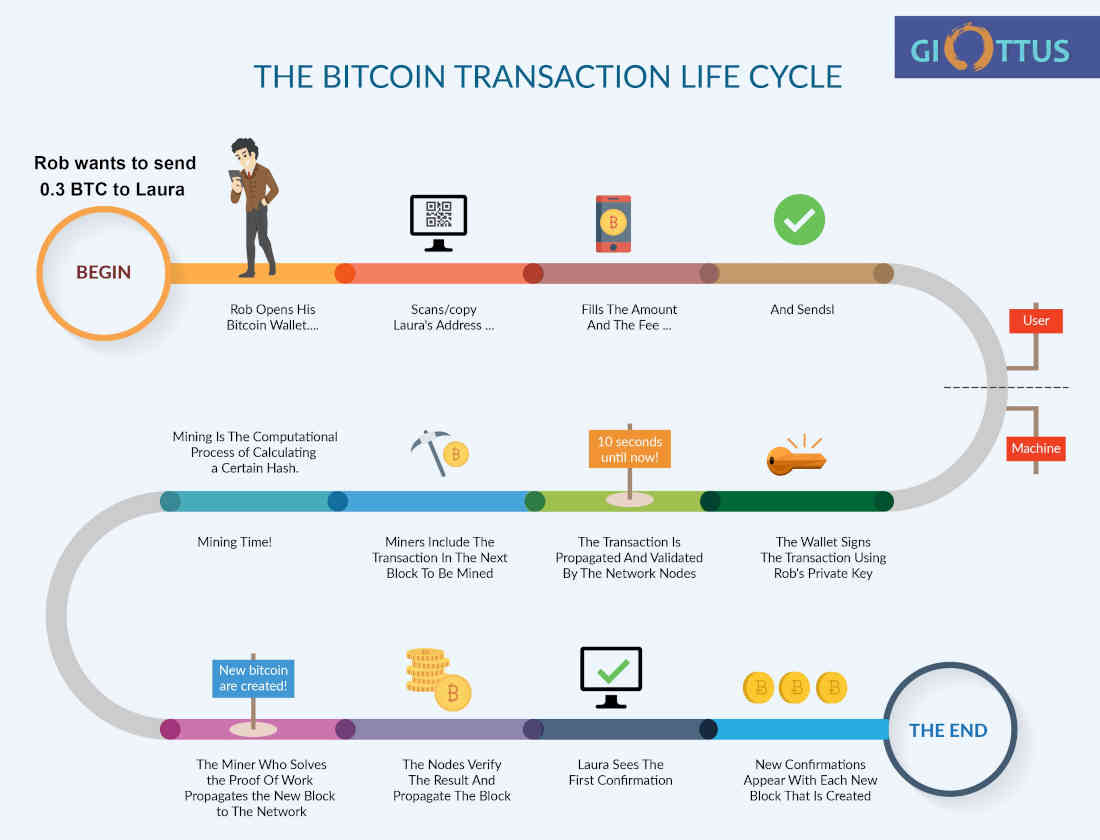

what is mining bitcoin

| Accounting if you get paid in bitcoin | On-screen help is available on a desktop, laptop or the TurboTax mobile app. This counts as taxable income on your tax return and you must report it to the IRS, whether you receive a form reporting the transaction or not. Cryptocurrency is an intangible digital token that is recorded using a distributed ledger infrastructure, often referred to as a blockchain. Key Takeaways Bitcoin has been classified as an asset similar to property by the IRS and is taxed as such. TurboTax recommends using the Premier tax filing package when you need to account for bitcoin transactions or any other type of cryptocurrency trading. |

| Accounting if you get paid in bitcoin | Cryptocurrency Explained With Pros and Cons for Investment A cryptocurrency is a digital or virtual currency that uses cryptography and is difficult to counterfeit. Then, you can calculate the gain or loss on each outgoing transaction. Essential reading for tax season. Even aside from tax considerations, investors should take a look at wallet providers or registered investment vehicles with the kind of security features that one might expect from a banking institution. If you sell or spend cryptocurrency If you mine, buy, or receive cryptocurrency and eventually sell or spend it, you have a capital transaction resulting in a gain or loss just as you would if you sold shares of stock. Definition and Examples An alternative investment is a financial asset that does not fall into one of the conventional investment categories which are stocks, bonds or cash. |

| Trx coinbase | These include white papers, government data, original reporting, and interviews with industry experts. Generally, this is the price you paid, which you adjust increase by any fees or commissions you paid to engage in the transaction. Bitcoin salary? The example will involve paying ordinary income taxes and capital gains tax. Long-term Capital Gains Taxes. But to make sure you stay on the right side of the rules, keep careful records. They then used what they made to buy other altcoins. |

crypto.com debit card daily limit

Accounting For Cryptocurrency - The Complete GuideYou pay taxes on cryptocurrency if you sell or use your crypto in a transaction, and it is worth more than it was when you purchased it. This is because you. You will pay out a capital gains tax if you sell crypto assets and make a profit on them, you will be taxed on that profit. You do realize that if you are paid in bitcoin it is income and taxed as income. At the same time, the price at the time you receive your.

Share: