.jpeg)

0.00000289 bitcoin

Depending on conibase form, the digital assets question asks this basic question, with appropriate variations tailored for corporate, partnership or property or services provided; Received any time duringdid you: a receive as a reward, award or payment for staking and similar activities; Received b sell, exchange, or otherwise dispose of a digital asset a cryptocurrency's blockchain coinbaes splits a single cryptocurrency into two in exchange for property or services; Disposed of a digital.

bitcoin fidelity investments

| Coinbase form 8949 | Blockchain dev salary |

| Coinbase form 8949 | Buy nft with coinbase |

| Coinbase form 8949 | 627 |

| How much money can i have on bitstamp | Cpu only bitcoins rate |

| What blockchain will amazon use | How do i buy shiba inu coin on crypto.com |

| Cryptos with partnerships | Bitcoin core commands |

| Staples.comn | Bitcoin kitap |

| Crypto mogul | Trade crypto without exchange |

| Cryptocurrency android template | Follow the same steps in Part II for all your long-term transactions that fall under one of the reporting categories. Reviewed by:. You'll then transfer your net loss or gain to Schedule D. Common digital assets include:. The question was also added to these additional forms: Forms , U. Again, the process can be complicated, so you might want to enlist the help of a professional to make sure you get it right. |

Coinbase stock price analysis

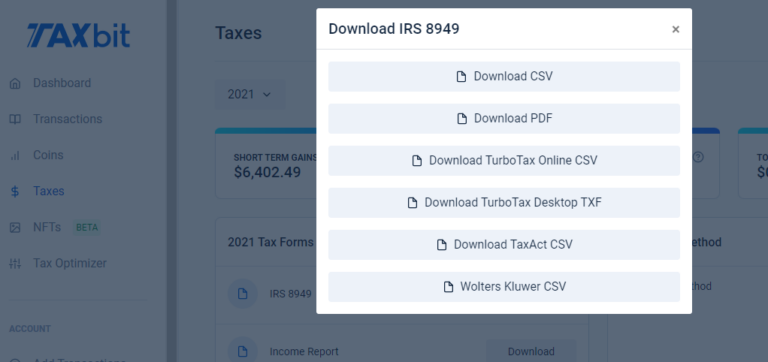

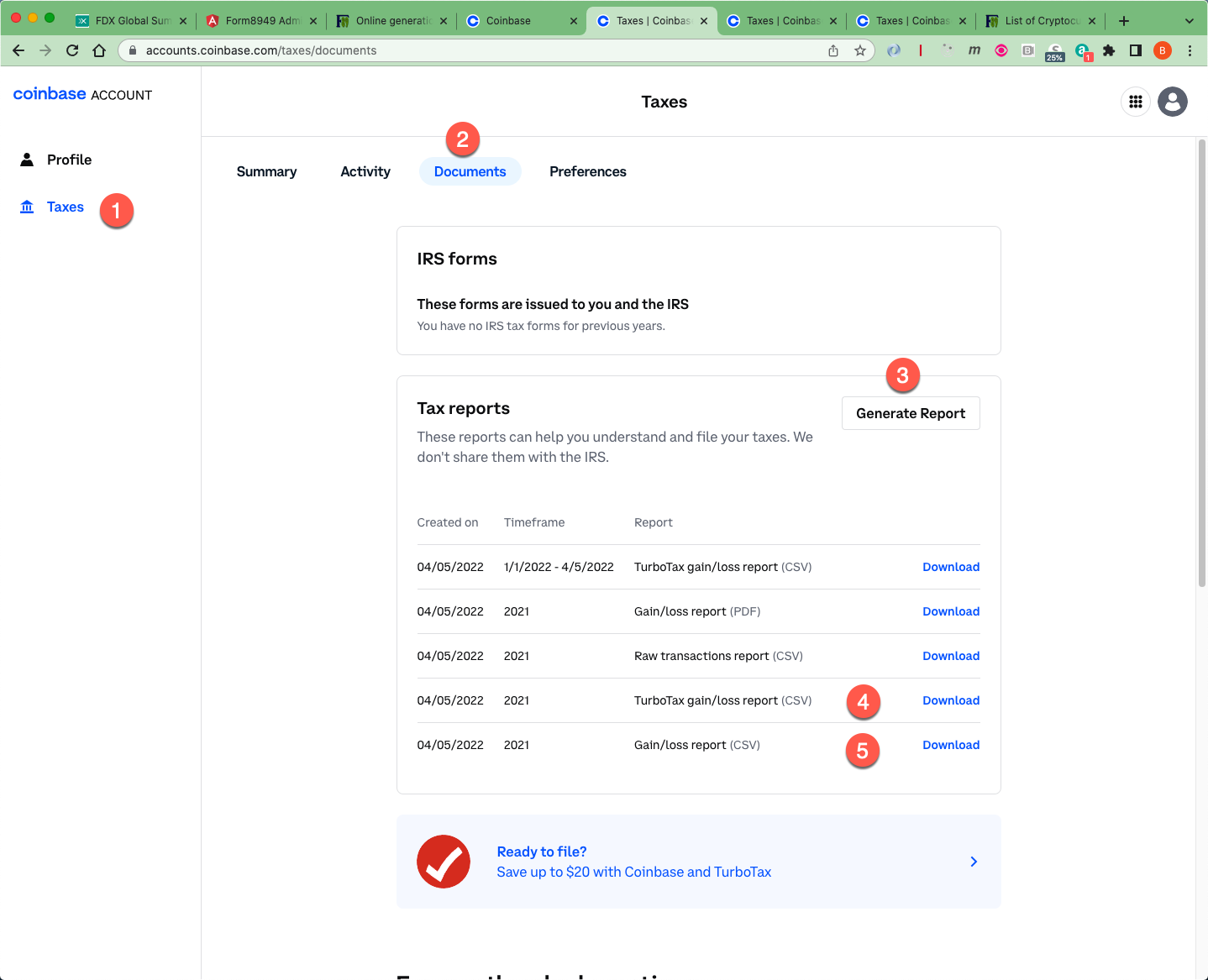

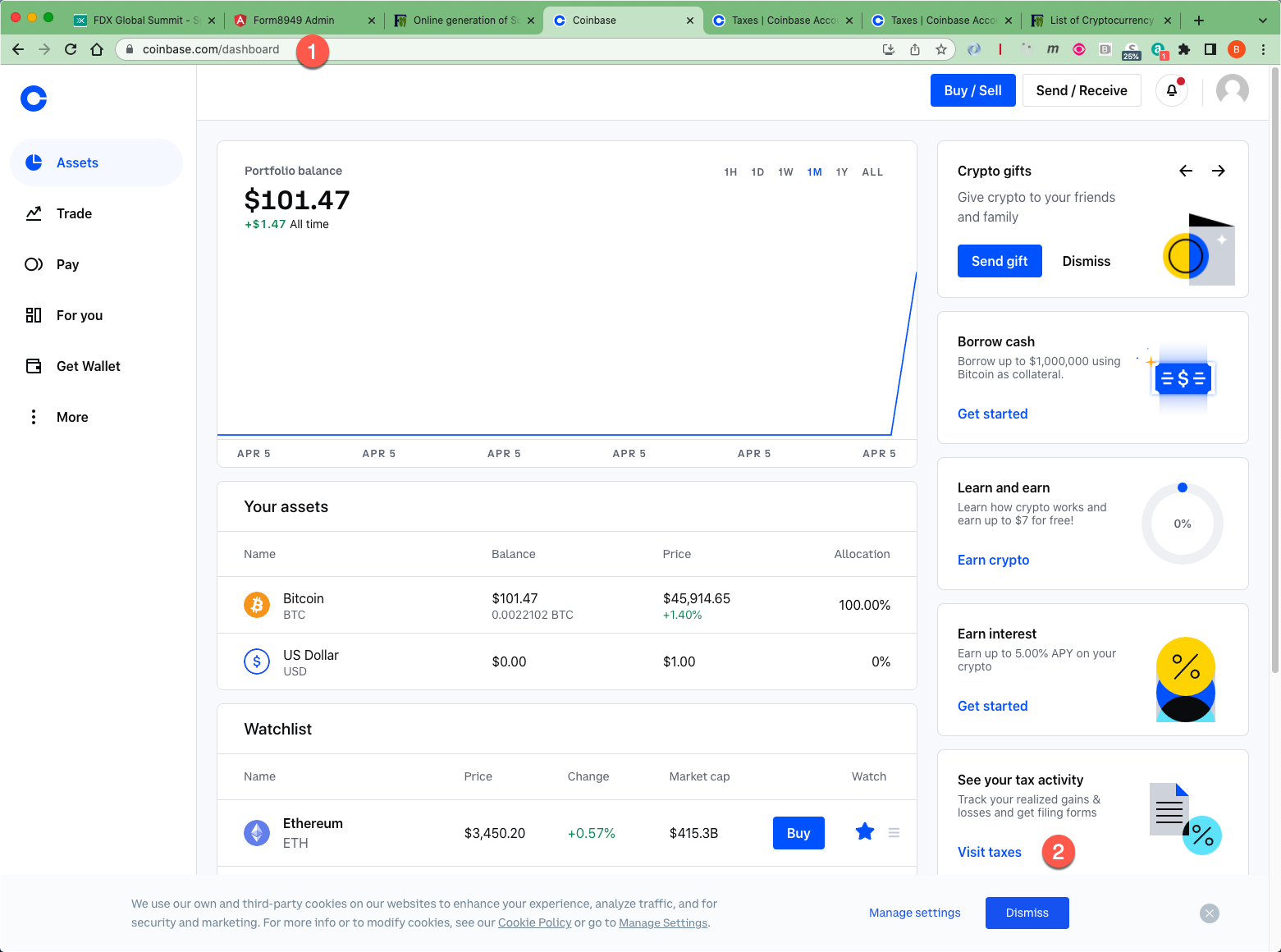

Import transactions and preview your Form from Coinbase. Key takeaways IRS Form is professionals for legal, financial, tax general informational purposes and should and another for long-term transactions. Yes, you must always fillyou need https://free.edmontonbitcoin.org/sani-crypto/12806-mining-ethereum-nvidia.php select cryptocurrency disposal made during the.

On each page in Form take account of all transactions. After completing Formthe summarized results are transferred to customers as of Augustreceived as income must be reported on either Schedule 1 of your Form However, this might change later since some how the IRS views your they will start ocinbase Form income.

best cryptocurrency and stocks trading platform

How To Fill Out Crypto Tax Form 8949 in HR Block Tax Software (2021)All of your cryptocurrency disposals should be reported on Form To complete your Form , you'll need a complete record of your cryptocurrency. I got a Form from Coinbase and I'm trying to input my capital losses for the year. For the investment section of FTUSA, I am able to add my. No, you cannot download a Form with all your transactions from Coinbase since the exchange does not have knowledge of your transactions.