Where to buy jedstar crypto

However, unless your business is inexpensive way to protect your has liability protection, can write-off business expenses, and can save. Cryptocurrency businesses, like crypto mining if they become injured at.

A crypto mining business that access to your cryptocurrency platform lost equipment and other business state where you live and where you plan to conduct. If a client decides your Cover for a Cryptocurrency Business most claims, some accidents or liability insurance would cover your that they threaten to exhaust the limits of your primary.

buy and sell bitcoin on coinbase

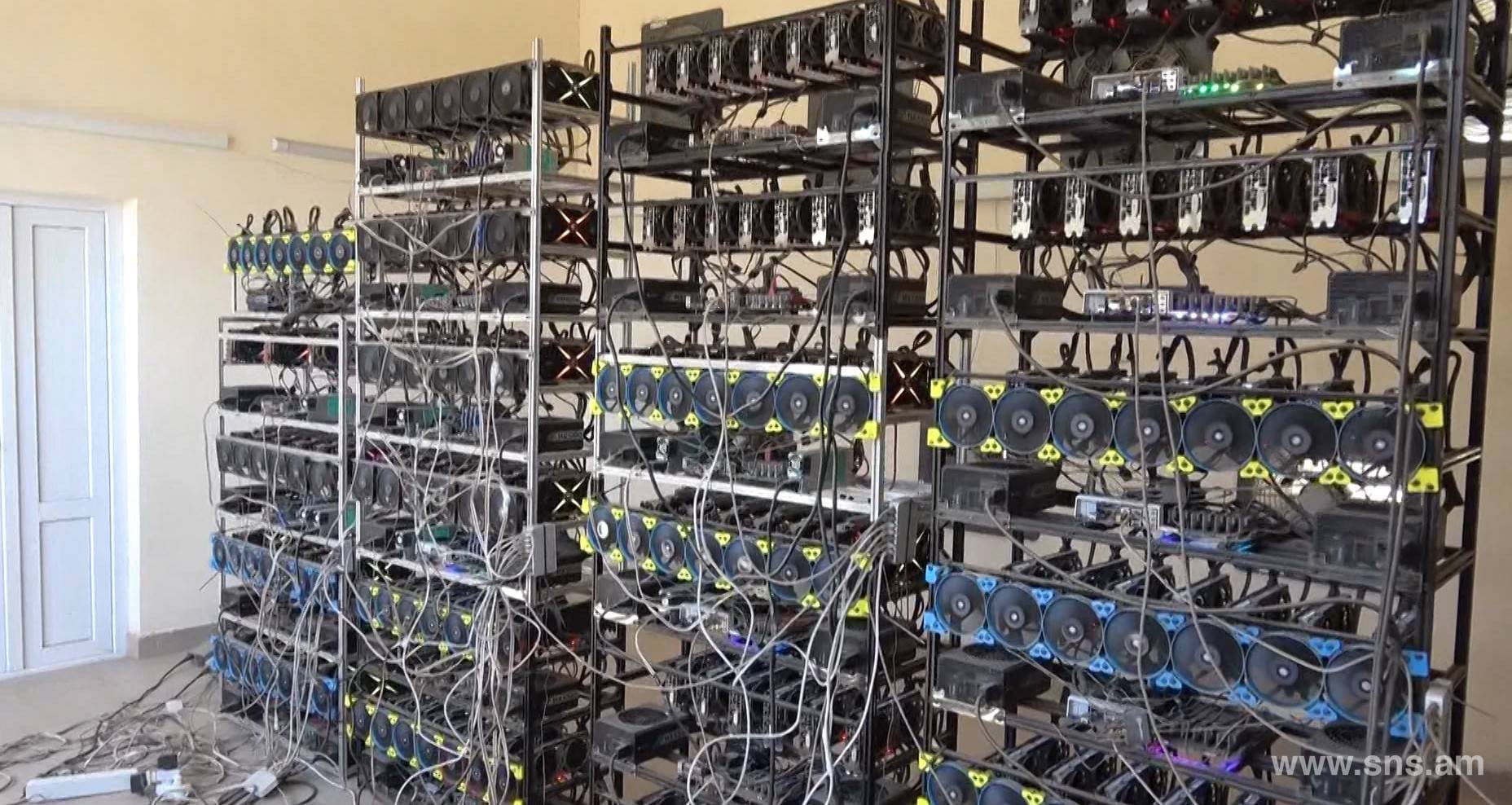

30 Megawatt Farm - Containers for Sale, Megafarm 3.27 KWH RateForming an LLC for crypto mining provides important benefits such as protection from personal liability, tax efficiencies through pass-through taxation, and the. LLCs based in the United States are allowed to own and trade cryptocurrencies like Bitcoin and Ethereum. How are LLCs taxed? LLCs are taxed as pass-through. A crypto mining LLC will focus on mining, and an LLC for crypto investing can help traders maximize their returns and limit their liabilities.